This famous quote made popular by Louis V. Gerstner, Jr.’s, who served as the Chairman and CEO of IBM from April 1993 until March 2002, memoir with the same title, aptly summarizes the latest quarterly performance by State Bank of India, the country’s largest commercial Bank in terms of profits, assets, deposits, branches and employees.

Read on…

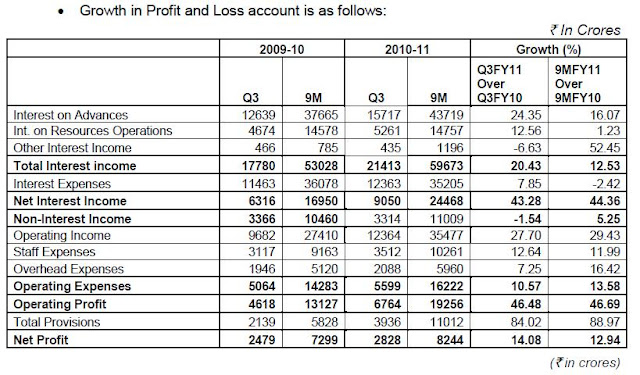

Major highlights of the bank’s ‘standalone’ performances for Q3 and 9-M (9-month period) for FY 2010-11 include:

Top line

· Net Interest Income (NII) up 44.36% in 9-month and 43.28% in Q3.

· In fact, NII, in absolute as well as in % terms, in all 3 quarters of the current financial year, FY11, are among the highest in the last ten quarters.

· Fee Income was up 27.25% in 9-M and 13.12% in Q3.

Cost

· Cost to income ratio has declined substantially by 639 bps YOY to 45.72% as on Dec’10 from 52.11% as on Dec’09. Compared to March 10, it has come down by 687 bps from 52.59%.

- CASA ratio was up by 523 bps to 48.17% (48.36% including interbank deposits). CASA deposits growth at 27.71%. CASA ratio.

- Cost of deposits came down by 72 bps from 5.92% to 5.20%.

- Growth in Interest Expenses was lower on account of robust growth in CASA. Interest Expenses on deposits fell 5.2% YOY for 9MFY11; however, the same grew by 3.22% during Q3.

- In a major surprise, operating costs on account of salaries was down by 9.295 for 9MFY11.

Bottom line

- Operating profit was up 46.69% in 9M and 46.48% in Q3

- Net profit grew by 12.94% in 9M and 14.08% in Q3

- Net Interest Margin rose 84 bps from 2.56% to 3.40% YOY in December’10 & at 3.61% during Q3FY11. In fact, a major highlight of the bank’s performance has been the consistent rise in its NIM for the five consecutive quarters beginning Q3FY’09.

- Return on Assets (ROA) up 2 bps from 0.94% to 0.96%

- PCR up by 788 bps YOY from 56.19% to 64.07%.

Amongst other highlights, the bank’s Advances grew from 19.15%, as on December 31, 2009, to 21.88%, as on December 31, 2010; though Advances market share declined marginally from 16.88% to 16.77%, during the said period. Further, according to the bank, the advances grew at 74% y-o-y in Q3FY11 while the sequential growth was much sharper at 502%, during the same quarter.

Further, deposits growth at 14% y-o-y in December’10 was better that 11.26% recorded in the same month a year ago, and much better from 8.36% in March’10. It could also grow its demand deposits market share from 15.35% in Dec’09 to 16.77% in Dec’10; but it witnessed a decline in deposits market share from 16.76% to 16.52%, during the same period.

Where the bank further impresses with its performance is the efficiency parameters. Its Net Interest Margin* (NIM), a key metric, rose sharply from 2.82% in Q3FY10 to 3.61% in Q3FY’10. Also, the bank’s cost to income ratio improved from 52.11% to 45.72%, during the said period. Besides, there was also significant improvement in cost of deposits which fell from 5.92% in Q3FY10 to 5.20% in Q3FY11.

Net Interest Margin (NIM) is the difference between interest earned and interest expended as a proportion of average total assets.

The bank’s Net NPA stood at 1.61%, as of Dec’10, which was significantly lower from 1.88%, recorded in the same month a year ago.

As per Basel II CRAR of the Bank is at 13.16% (Tier I: 9.57%) as at the end of Dec. 2010, compared to 13.77% last year. As per Basel I CRAR is at 11.95% and Tier I is 8.69% as on Dec 10.

Carry on, SBI

The bank’s consistently good show in the last few quarters in terms of all the key parameters is a clear indication that it is not here to be bogged down by rivals, especially from private sector, and that it will fight tooth and nail the battle for retaining its market supremacy.

However, as the economy enters a hardening interest rate regime courtesy the stubborn and the runaway food and oil prices led inflation, repeating the past performance won’t be that easy.

However, for now, who can say elephants can’t dance?

No one, at least for now.

No comments:

Post a Comment